Video telematics developed in partnership with leading insurers, accident management companies and insurance brokers

VisionTrack’s multi-award winning IoT video telematics solution is continually evolving to transform how insurance businesses support their fleet customers.

What our partners say

Some of many insurance benefits of video telematics

Our scalable, cloud-based platform has gained considerable recognition, receiving prestigious accolades from both Gartner and Celent Model Insurer, as well as winning a growing number of high-profile insurance industry awards.

Decrease claims costs

Reduce claims frequency

Defend liability

Control claims management

Faster claims resolution

Reduce legal and admin costs

Mitigate third-party costs

Improve loss ratios

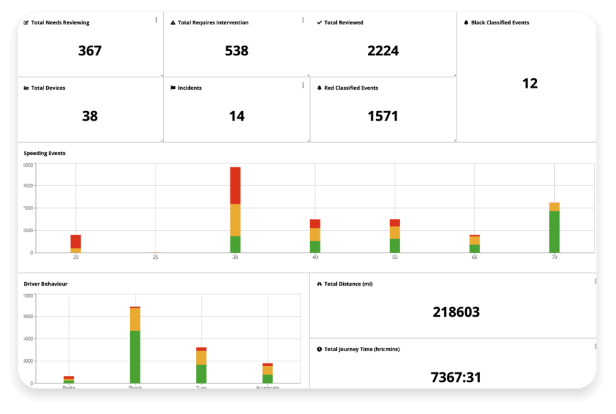

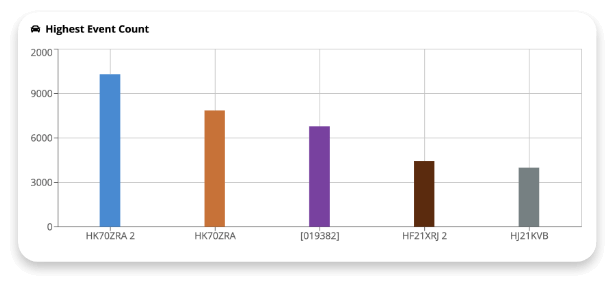

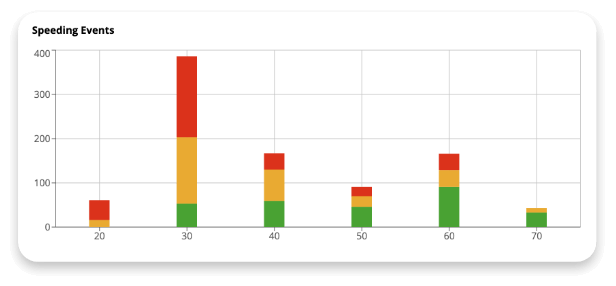

Reduced frequency and cost of claims

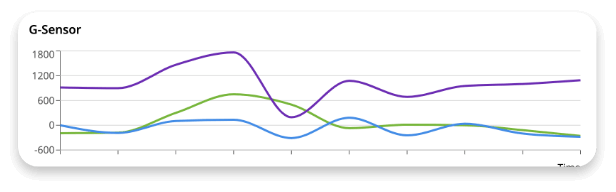

Our IoT platform is already delivering impressive results by improving loss ratios with reduced frequency and cost of claims. With access to real-time and historical snapshot images, video footage and supporting data, one fleet insurer is already achieving an average reduction in claims frequency of 24% and an average 34% decrease in claims costs.

Make instant and accurate liability decisions

Using undisputable video evidence and supporting driver and vehicle data from our intelligent video telematics solution makes it possible to make instant and accurate liability decisions. This allows the claims management process to be revolutionized, dramatically increasing claims handling efficiency and reducing associated costs. Faster decisions mean a significant reduction in legal and administrative costs.

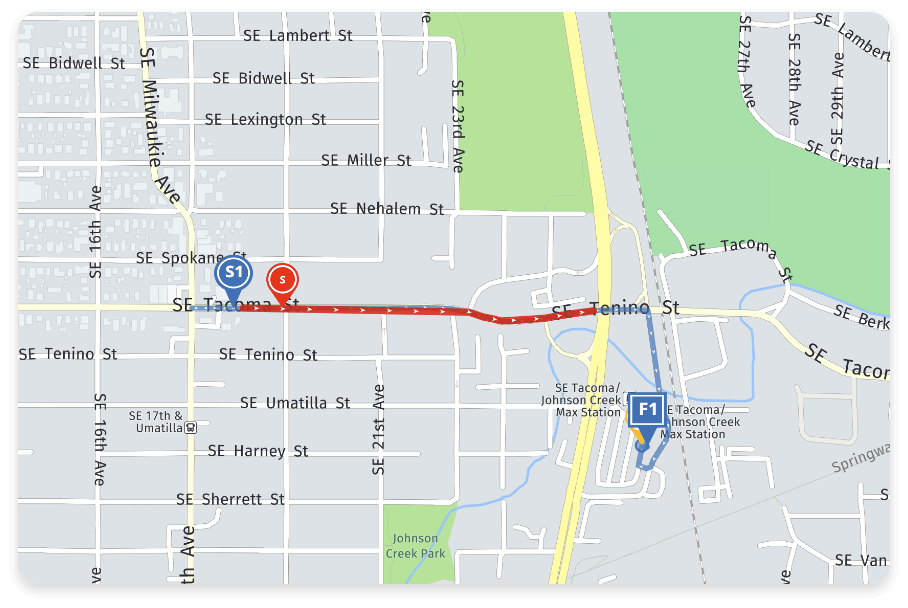

First Notification Of Loss

Video telematics has shown to play an important role in First Notification Of Loss (FNOL) and Third Party Intervention (TPI), which are vital to keeping claims costs to a minimum and increasing the average speed of resolution. By controlling claims from start to finish, at the earliest stage possible after an incident, there is an opportunity to better manage third-party costs and achieve greater savings potential.

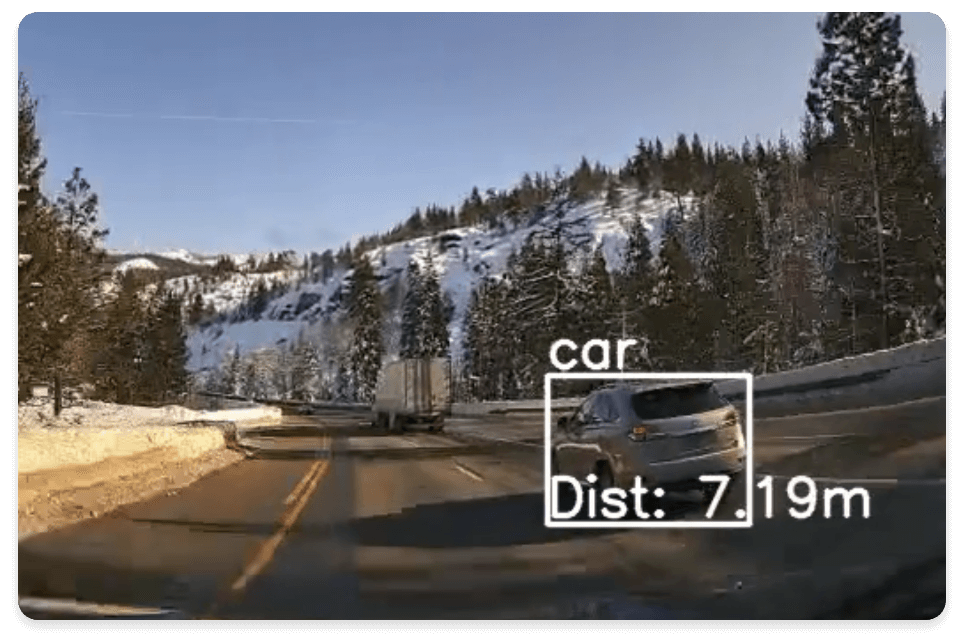

Eliminate the impact of fraud using the latest video telematics

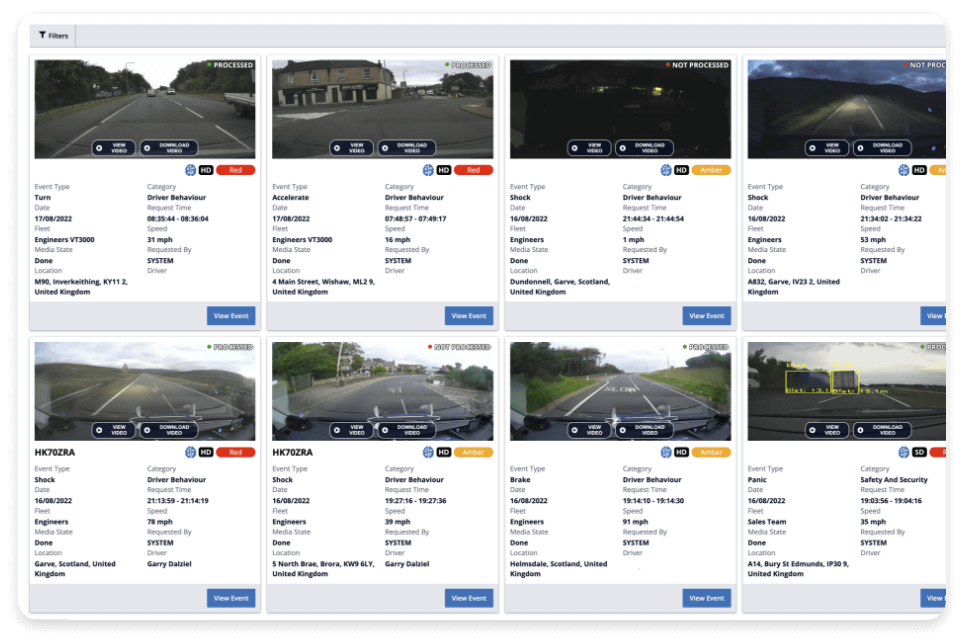

Fleets are particularly vulnerable to fraudulent and exaggerated claims, resulting in more incidents, inflated cost of premiums and increased claims. Eliminate the impact of fraud using the latest video telematics, insurtech and computer vision technologies. Detect and dispute suspicious claims by having access to snapshot images, video footage and supporting vehicle data.

Utilize the added insight and real-world data provided by our video telematics solution to support sustainable business

Pushing the boundaries with AI and computer vision

Using increasingly sophisticated AI technologies, we are automating management processes, data analysis and incident detection to revolutionize the claims management process, dramatically increase claims handling efficiency and reduce associated costs.

The functionality, scalability and capacity of the IoT platform, Autonomise.ai, enables us to develop intelligent edge-and cloud-based solutions, so the insurance sector can take advantage of smart camera solutions and use video telematics like never before.